Q: We have built a termination tool to automate the payout of balances when an employee finishes up. This can be configured to payout only those leave categories required (e.g annual leave but not sick leave) and pay at the dynamic rate of those categories.

We have clients with differing opinions on whether a further 8% should accrue & pay out on that termination pay for the alternate days and annual leave entitled. Do you have any information that might help us determine we need to factor this in. The best information I could find was the document I have attached but I then spoke to another client who didn’t think they would pay 8% on top of the termination.

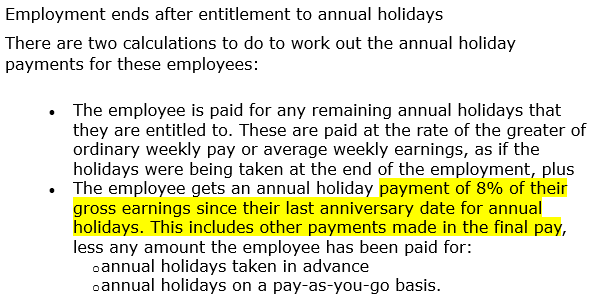

A: On termination, anything that is taxable and paid in the termination pay is part of the 8% on termination (except a true discretionary payment).

- Section 24, 25 26 cover entitlement paid after 12 months, and if paid out it is also included in the 8% as well (it is not excluded)

- An alternative holiday paid out is part of gross earnings so is part of the 8% on termination

Reference:https://www.employment.govt.nz/leave-and-holidays/calculating-payments-for-leave-and-holidays/calculating-payment-for-leave-and-holidays-in-final-pay/