Q: We are having a bit of an issue with a client – they are undergoing an audit by what seems to be an Australian-based company.

The crux of it is that they are telling us we should be dividing the employee’s previous month’s earnings by 4 weeks/160 hours to determine OWP.

We are dividing the employee’s previous month’s earnings by 4.33 weeks/173.33 hours.

The guidance seems pretty clear to me, as it says to go back 4 weeks (or length of pay period if longer than 4 weeks).

If you divide an employee’s month’s earnings by 4 weeks/160 hours, the employee’s OWP rate will always be higher, even if the employee earns nothing other than base salary.

I am sure that we are correct here, but they seem to be ignoring everything I say, so a confirmation from you as a third party would be helpful.

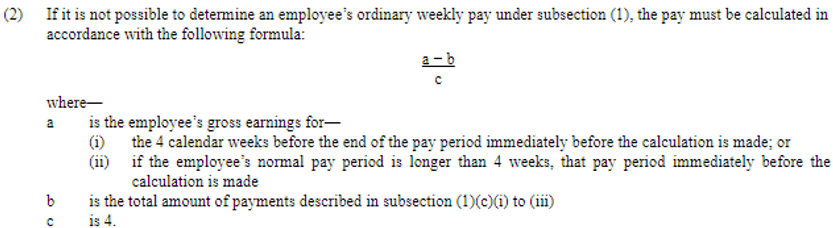

A: If you are using OWP the 4-week average, you must use 4 and not 4.33. As 4 is defined under the act and you cannot contract out.

Q: The guidance states – work out the Gross for that period. You must be able to take a month’s pay – then divide it by 4.33 and multiple it by 4 to determine the last 4 weeks earnings?

A: Where does it state the divisor changes to 4.33 for employee that is monthly paid. It is about the gross earning, not the divisor.