Q: Would it be possible for you to send me the legislation and supporting document that when employees take annual leave, we still have to pay superannuation on annual leave?

A: Superannuation (an agreed scheme) and or KiwiSaver? Both are based on the taxable gross and annual leave and any other type of taxable paid leave agreed or by law are part of the employee taxable gross earnings that super or KiwiSaver are based on.

In regard to tax leave paid is taxed under Salary or Wages.

Here is one just for KiwiSaver but the same for Super:

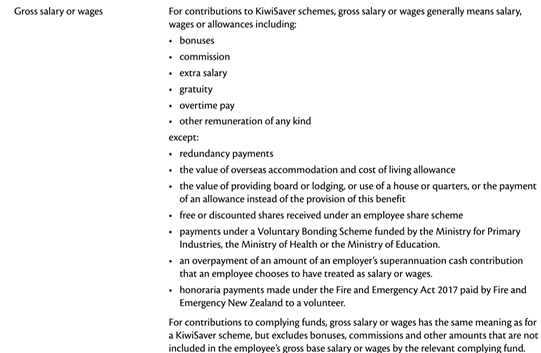

From the IRD KiwiSaver Employers Guide Glossary.