Q: We have an employee who has been made redundant and his final pay is due in the beginning of the 2022-2023 financial year (it will be sometime in April).

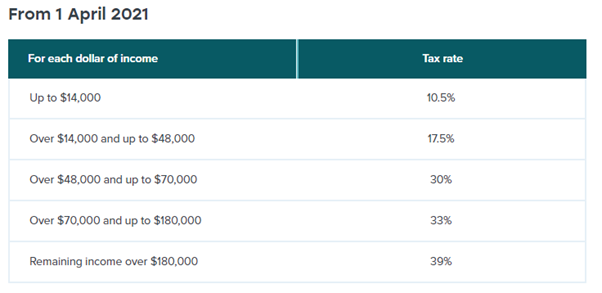

Based on the below table (given the table effective 1 April 2022 has not yet been released), his tax rate is current in the 30% bracket.

He has requested that his final redundancy payment be taxed at either 10.5% or 17.5% given he is unsure of what his income will be with a new job in the new financial year.

He has advised he is prepared to pay any tax owing come EOFY March 2023.

Is this something we can fulfil (via submitting an updated Tax Declaration Form)? Or will he need to apply for a tailored rate?

A: Wishful thinking on the part of the employee. You do not take into account anything is regard to what the ex-employee will be earning after they leave their employment with you. An extra pay looks at the last 4 weeks to determine an annualised amount (it does not look forward).

You do not act on the employee instructions to pay less tax (you can act on if they want to pay more, in writing). If you follow their instructions is could be seen as tax avoidance.